[ad_1]

Australia’s finances have been hit by a $21.8 billion downgrade over the next four years as spending rises and tax receipts fall.

The deterioration of the fiscal bottom line was revealed in Wednesday’s mid-year economic and fiscal outlook, which updated projections made in May’s federal budget.

The projected deficit for the current financial year — 2024/25 — improved by $1.4 billion to $26.9 billion.

But the underlying cash balance will deteriorate over the next three years, leading to a larger deficit of $31.7 billion in 2027/28. and gross debt will be $49 billion higher than budgeted.

The return to red ink on the government books follows two consecutive surpluses of $22 billion and $16 billion in 2022/23 and 2023/24 respectively.

Global uncertainty and spending pressures have led to “some slippage” in the budget’s bottom line, Treasury Secretary Katie Gallagher said.

“Despite the pressures coming at us, we are on track for a soft landing and our budget strategy is helping,” she said.

Spending is projected to increase by $25 billion from the budget estimate, including $16.3 billion in “automatic” increases through indexation and other increases in pensions, veterans support and disaster relief funding, among other payments.

It also includes $8.8 billion in “unavoidable” increases, including expanding measures such as Pharmaceutical Benefit Scheme rolls and aged care programs that have faced funding problems.

Previously, the government could count on rising revenues, mainly due to tax increases from China’s strong demand for minerals, to pay for rising costs.

Wednesday’s update ends a run of huge upward revisions to tax receipts in the past four MYEFOs, which have averaged $80 billion a year.

Company tax receipts were cut by $8.5 billion over the four-year budget cycle – the first downward revision since 2020/21. – largely due in part to China’s sluggish growth prospects.

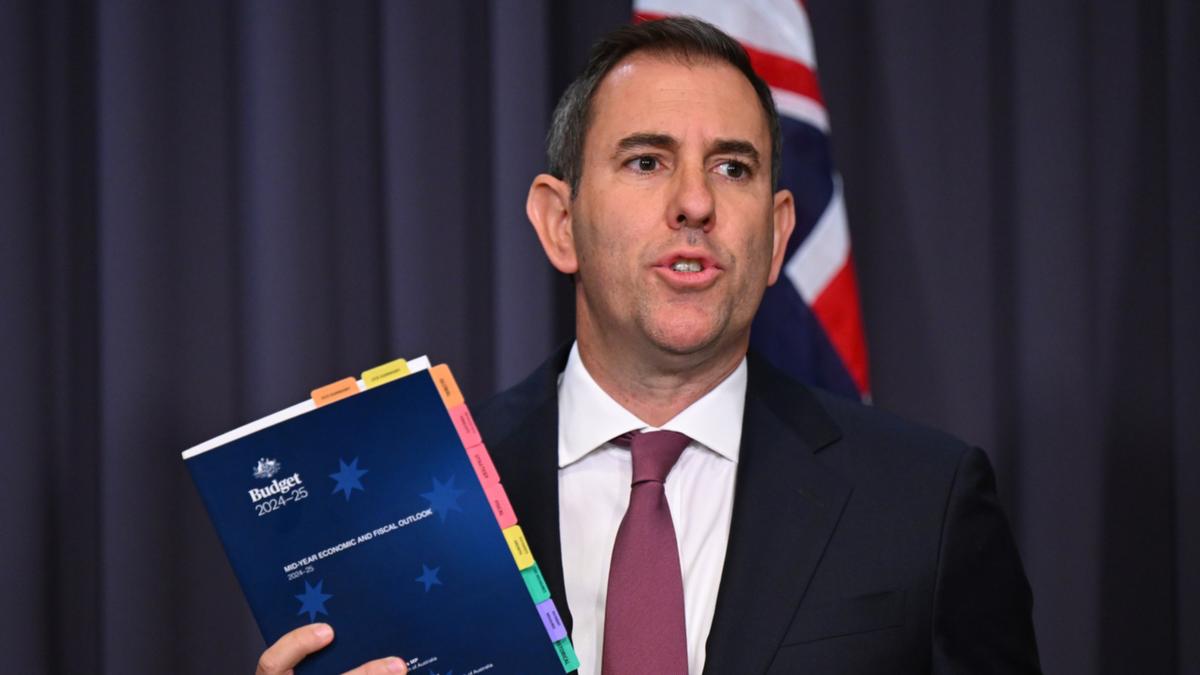

The government’s “responsible budget management” has helped inflation fall after the 2022 election, while providing relief to Australians’ living costs, Treasurer Jim Chalmers said.

“We’ve struck the right balances here, a very responsible set of books, striking all the right balances, recognizing that fighting inflation is our number one priority, but we can’t ignore our responsibilities to people and we can’t ignore the risks to growth,” he said to Sky News on Wednesday.

The government has offset some spending growth by finding $14.6 billion in savings, or “redirected” funds.

Gallagher praised the government’s restraint in banking 78 percent of the upward revisions to revenue since the election, helping to pay down the debt and avoid $70 billion in interest costs over the decade.

“Our predecessors increased gross debt to about 40 percent of GDP and expected it to remain there until the end of the medium term,” she said.

Workers are poised to see wages rise at a slower pace than predicted in May.

Forecasts for wage growth were cut by a quarter of a percentage point to 3 per cent in 2024/25 and 2025/26 and 3.25 per cent in 2026/27 before accelerating to 3.5 per cent in 2027/28, in line with the budget forecasts.

Meanwhile, the economy is expected to grow 0.25 percentage points slower this financial year than previously forecast, at 1.75 percent.

“We know that growth in our economy has slowed more than we expected in the Budget due to a combination of higher interest rates, pressures on the cost of living and global economic uncertainty,” Senator Gallagher said.

“That’s why our economic plan is all about fighting inflation without ignoring the risks to growth.”

Unemployment and inflation forecasts remain unchanged from the budget, with price growth still forecast to stabilize at the Reserve Bank’s target of 2.5 per cent in 2026/27.

[ad_2]